Friday Fake Out: The Sultans of SWAIN- the aftermath of Tiffany's epic counterfeiting battle over Costco

Admit it: if you got to Costco, there is something intruging about the jewelry section—specifically when it boasts $10K "Tiffany & Co." rings for a mere $2500. How can that be? Costco certainly is the place where discounts run plentiful, but this seems too good to be true. Here's a little secret: it is.

#TBT WJA Keynote speech re: HENRYS: Who are they and where are they now?

In March of 2016 I had the insanely awesome opportunity to address the esteemed members of the Women's Jewelry Association's "In the Know" at their annual meeting. In my keynote speech, I discussed the state of the economy when it comes to making luxury purchases. Check out my predictions.

Is there really a "war on Christmas?"

THIS IS NOT A “WAR ON CHRISTMAS." Let’s call it what it is, lack of biblical references in holiday advertising it’s not a war on Christmas, it’s people feeling like they are being forced to be politically correct and using the Christmas holiday to express that. The AFA (American Family Association) is a religious organization that is leading the crusade. The problem is, their methodology among a whole slew of other things. I discussed this on The O'Reilly Factor last week- check out my research and our discussion!

5 Scams to be aware of this Black Friday + Holiday Season

What's up with Black Friday 2016?

I went on MSNBC to talk about what to expect this Black Friday. As I said in an earlier blog post, this year's Black Friday is more of a "Grey November" and more people are starting to do their shopping online starting September 30th. One difference in this year's Black Friday is the uptick in app usage to find good deals. People are using apps like RetailMeNot to show price differentiation to make sure they're paying the best price possible. Apps like RetailMeNot are able to check which discounts are going on at which stores, and then offer coupons to users to get even better deals. Clearly the Internet Age and the ability to research beforehand is having an effect on consumer behavior—smarter purchase decisions are just a click or an app download away!

Is Black Friday relevant?

Why is Black Friday so early this year? watch Abc World at 6:30PM Et. to find out!

Got questions about Black Friday? You're in luck. Catch me on ABC World at 6:30 ET for all the details!

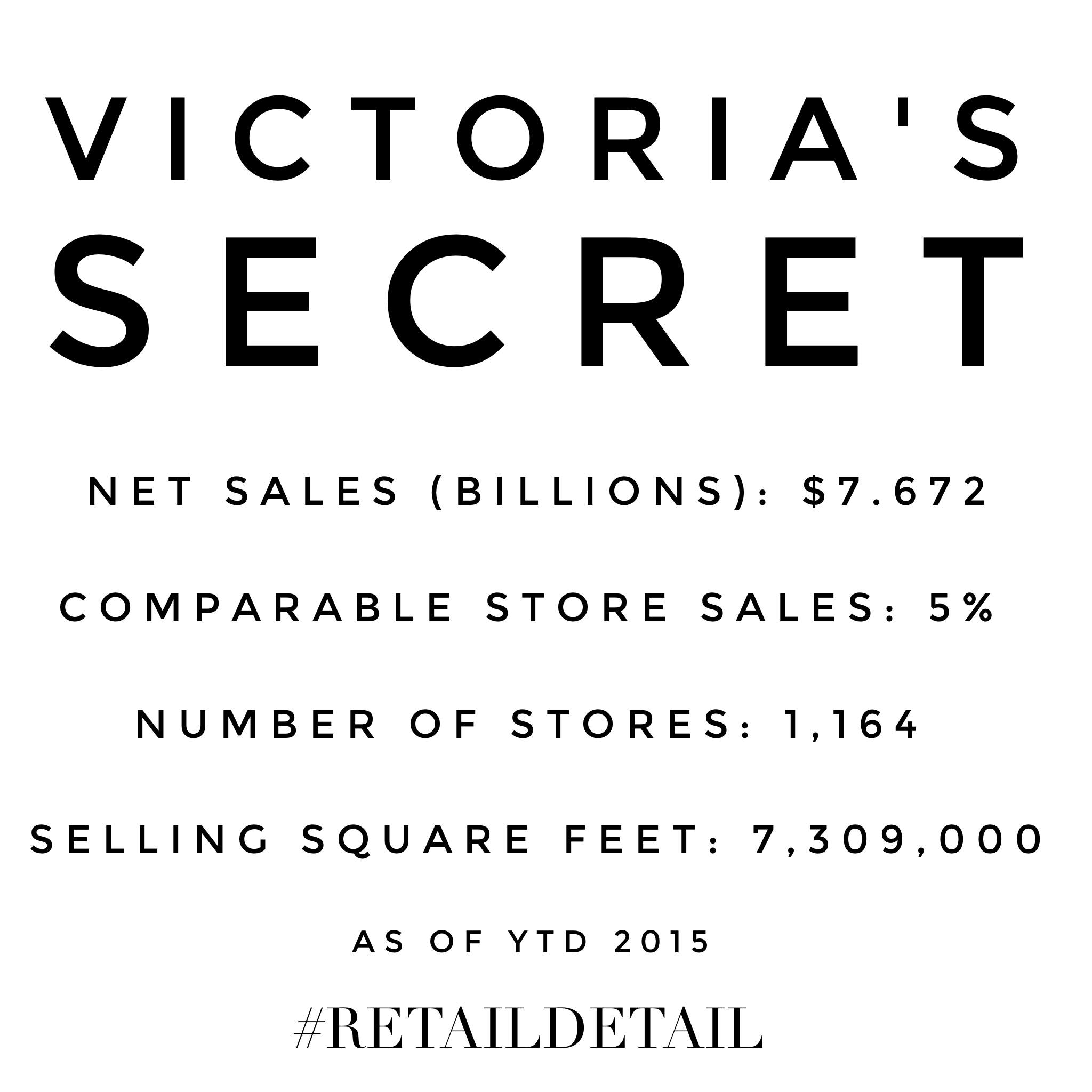

#RetailDetail Victoria's Secret

Retail Shares Struggle on Tougher Outlook- WWD

(Re-published from Womens Wear Daily January 27th, 2014 written by Arnold J. Karr) For retailers, the disappointments keep coming.

After an abbreviated holiday season in which unprecedented levels of promotion failed to generate increases in traffic and further depleted top-line results, stores are now facing disappointing January sales, observers say, and the inability of promotions to clear inventories as they had hoped.

Adding harsh winter weather to an already icy fiscal mix, expectations for fourth-quarter earnings and inventory levels have taken on a far more negative tone and retail shares have started 2014 by moving in reverse. After rising an eye-opening 43.9 percent in 2013 as hopes for consumer spending strengthened, the S&P 500 Retailing Industry Group has fallen back 5 percent so far this year, shedding 2.1 percent last week alone. In 16 trading days so far in 2014, the index has trended down in all but four, including the last seven in a row.

The index’s recent weakness worsened Friday in an abysmal day for the market overall. The Dow Jones Industrial Average fell 318.24 points, or 2 percent, to 15,879.11, and the S&P 500 contracted 38.17 points, or 2.1 percent, to 1,790.29. The retailing index declined 1.9 percent to end the week at 892.58.

In a single day, the Dow, S&P 500 and retail index surrendered the respective milestones of 16,000, 1,800 and 900 attained at the end of 2013. Retail last year outperformed the Dow, which rose 26.5 percent, and the S&P, up 29.6 percent.

But that was before many retailers began reporting disappointing numbers for holiday and pulling down their earnings projections accordingly. In a research note entitled “Frozen by Polar Vortex, Slow Economy,” Jharonne Martis, director of consumer research at Thomson Reuters, noted that “pre-announcements” among retailers, who will begin reporting fourth-quarter results next month, have been overwhelmingly negative. Of 92 companies — apparel and broadlines retailers among them — who have updated guidance for the quarter, 74 have lowered projections, 15 have lifted them and three have left them unchanged.

The biggest declines among U.S. retail stocks so far this year have come from companies that needed to pull down fourth-quarter projections based on in-store and even online weakness. The Bon-Ton Stores Inc. cited “unfavorable winter weather conditions” earlier this month when it said it faced the possibility of a fourth-quarter loss. After boasting of earlier comparable-store gains, J.C. Penney Co. Inc. provided no specific numbers when it reported it was “pleased” with its holiday performance and soon after said it would close 33 underperforming stores in a cost-cutting move. Sears Holdings Corp. projected a larger-than-expected loss for the quarter when it divulged that comps in November and December were down 7.4 percent.

Lululemon Athletica Inc. reduced profit expectations after revising its comp outlook to down in the low- to midsingle digits, after initially expecting a flat quarter as it moves to recover from a problem-plagued year in 2013. On the same day, Ascena Retail Group Inc., Express Inc. and Stage Stores Inc. brought down earnings expectations, as did L Brands Inc., parent of Victoria’s Secret, based on disappointing comps.

Teen retailers struggled through 2013 and have continued to do so as 2014 gets under way. Retail Metrics Inc. expects the teen sector to collectively report a 7 percent decline in fourth-quarter comps and described it as the “weakest of any retail segment.” Fourth-quarter comps among all reporting retailers are expected to grow just 0.7 percent — 1 percent excluding Wal-Mart Stores Inc.

Aéropostale Inc. has seen its shares wither 20.1 percent this year, after declining 30.1 percent in 2013, after it canceled plans to appear at the ICR XChange in Orlando, Fla., this month, with speculation that it might be in talks to be taken over by any number of private equity players giving way to complaints among analysts about a lack of transparency.

American Eagle Outfitters Inc., considered by many to be best positioned to recapture some momentum in the teen market, turned heads last week when it said that Robert Hanson was out as its chief executive officer, succeeded on an interim basis by chairman Jay Schottenstein.

“Of the Three A’s” — American Eagle, Aéropostale and Abercrombie — “a lot of people felt that American Eagle was the strongest and Hanson had made a positive difference,” said analyst Janet Kloppenburg, president of JJK Research. “Now they have to bring in a new ceo who’ll go through a honeymoon as he or she figures out what to do with the assortment, how sharply to discount remaining inventory.

“And it’s disturbing when you see heads start to roll at good companies in any case,” she added.

Kloppenburg noted that some of the weakness in stocks in general is derived from doubts about, for instance, the strength of the manufacturing sector in China and uncertainty in many emerging markets. Retailers’ concerns are less global in nature, she said.

“Analysts, myself included, expected margins to be tough and sales to be challenging, but we figured that, with discounting, there’d be some success in working inventories down and moving the needle at least a bit in January,” she said. “But the discounts are deeper and it doesn’t seem to be generating traffic or sales, and a lot of us are beginning to look at our estimates for retailers for the first quarter, both the top and bottom line, and wonder if they need to be brought down. There’s no overwhelming fashion trend coming for spring and there are a lot of questions about inventory. There is a large body of evidence telling investors to be conservative.”

Craig Johnson, president of Customer Growth Partners, expects that final holiday numbers from the Commerce Department will point to a 3 percent gain in spending for holiday merchandise once adjusted by the government. He noted that while winter storms and the abbreviated holiday calendar hurt results last year, a more fundamental challenge was simply a lack of spending money in consumers’ wallets. The Commerce Department’s Bureau of Economic Analysis reported growth in disposable personal income of just 0.1 percent in November.

“If there’s no real disposable personal income growth, you will never have strong retail spending growth,” he said, noting that the metric ran above 3.5 percent in the years prior to the Great Recession.

He noted that the apparel business has shifted from wants to needs, with consumers more interested in subscriber-based services providing experiential value, such as cable and telecommunications providers. And, with inventories growing faster than comps at retail, promotional proclivity has lingered, driving down dollars per transaction and further limiting revenue gains.

Johnson noted that the growth in online shopping is among the factors pushing up the rate of merchandise returns to retailers, eroding fourth-quarter results further. Promotions have contributed to the growth in returns observed by Johnson and his associates.

“They tend to get people goosed up beyond what they can afford or like,” the CGP official said.

Rebecca Duval, an analyst at BlueFin Research Partners and a former retailer, said that the reluctance to pad inventories was being felt throughout the industry supply chain now, with orders being pushed back, reduced in size or in some cases canceled altogether. “The Street is going to be looking for margin recovery in the first quarter,” she said, “and it’s not going to be easy to come by. Investors are asking who has a fundamentally strong story for 2014, and there will be some winners, but a lot of the analysts’ numbers are going to have to come down for a lot of the companies they cover first.”

LGP and TOPSHOP: Why we care.

By now you've probably heard. LGP has bought a 25% equity stake in TOPSHOP in a move to expand presence in the US. The entire deal was for $805 million almost DOUBLE the amount dealmakers initially thought they were going to get. For fashionistas out there reading this, I'm going to back up and explain who and what LGP is. Leonard Green & Partners is a private equity firm that tends to make significant investments in retailers like Whole Foods, JCrew, Neiman Marcus, PETCO and The Container Store. The firm's involvement is MAJOR since a ton of British brands have tried to come state side, and have failed. For market followers there are two major take aways: 1) with this investment, TOPSHOP is now valued at $3.2 billion and 2) the company is now cash positive and ready to make siginificant investments/acquisitions in other of the Arcadia businesses/companies. In the last year Arcadia (the holding company of Sir Philip Green's companies including Miss Selfridge, Evans, Dorothy Perkins) has seen a pre-tax profit increase of 25%.

And since it's Throwback Thursday, check out an old report I did for the launch of the TOPSHOP store here in NYC. Good times.

HIP Retail Detail: US port strike ends, Philip Green to sell Topshop stake + GAP stock pulls down sector

L.A. Ports Strike Ends, Focus Shifts East (via WWD): http://www.wwd.com/business-news/government-trade/la-ports-strike-settled-6521728?src=nl/newsAlert/20121205-3

Gap Stock Pulls Down Retail Sector http://www.wwd.com/business-news/financial/european-markets-edge-up-6518624?src=nl/newsAlert/20121204-4

Best Buy Moving Dividend Payment up to December in Anticipation of Potential Tax Increases for 2013 (via Bloomberg Businessweek): http://www.businessweek.com/ap/2012-12-05/best-buy-moving-up-dividend-payment-date-to-dec-dot

Black Friday starting with Best Buy

Oh hi. Yes I know I've been away from the blog for a while and with good reason. With Black Market Billions off to an awesome start, I've been asked to write more books (3 to be exact). I've also been soul searching. Details for all projects including my "summer of Hitha" TK, but first let's get to Best Buy. This is a retailer I've been following closely since 2010. Why? Because it was once the star of the S&P and one of the bellwether retail stock. Um, not any more. Former Best Buy CEO, Brian Dunn made some pretty crap choices in the merchandising, product mix and overall sales strategy of the store. The result? Shoppers now go to Best Buy (which was once a destination to PURCHASE all things electronic and tech) to price compare. Sales have been slowly dropping off. And internet superstore Amazon is taking market share away from Best Buy. So here's a question- do you go to Best Buy only to price compare? If you do you aren't alone and Best Buy executives are finally cluing in. Here's the thing- they don't think there is anything WRONG with the idea of "showrooming." In fact, when new CEO Hubert Joly presented his five step plan to get the company back on track at the investor day, showrooming was one area he wanted to focus on. Question is-- will it help or is it a case of "too little, too late?" The awesome Jeff Macke host of Yahoo! Finance show Breakout and I agree- the concept of a showroom is quickly becoming a thing of the past. And Best Buy better realize that-- FAST.

Is luxury back? Coach beats estimates with 2Q earnings

(A luxury obsessed consumer. Picture courtesy of Racked.com)

(A luxury obsessed consumer. Picture courtesy of Racked.com)

Coach reported better than expected profits today. Net income rose to $303.4 million, or $1 a share up from $241 million or 75 cents in 2Q of last year. Sales rose 19% to $1.26 billion and the company expects sales and profit to increase at least 10% through 2011. In addition, Coach plans to repurchase close to $1.5 billion of shares by June 30th, 2013.

With those kind of numbers it's hard not to seriously wonder if the luxury retailers are finally back. Or is it?

Mike Tucci president of Coach's North American retail division credits three main reasons for strong sales during the holiday season: product performance, digital strategy and progress on the new mens intiative. Tucci specifically notes Coach.com is the fastest growing full price channel in North America and experienced double digit growth during the holiday season. "We will continue to use digital capability as a touch point for the customers," he said on the earnings call. So what are some of the pitfalls for Coach? For one, gross margin estimates missed the street's expectations coming in at 72.4% compared to 73.2% due mostly in part by an increase in sales at their lower priced outlet stores. Second, Coach's market share in Japan continues to contract. But, with expanding market share in China (Frankfort referred to China as "our fastest growing business.") and a potential move of production to lower labor cost countries such as India, Coach may still see some bright days ahead in 2011.

Coach wasn't the only luxury retailer to report stellar earnings supported by significant growth in China. Burberry reported a 36 percent increase in sales reflecting the deal to take over 50 stores from the retailer's Chinese franchise partner. Likewise, the new "digitally enhanced" flagship store in Beijing drove significant traffic. "There is an underlying growth in the Chinese luxury sector anyway, but the main driver has been making sure our stores are properly stocked," said Stacey Cartwright, chief financial officer. "Previously, lean levels of inventory meant a lot of sales were walking out the door."

Luxury conglomerate Richemont reported a 7 percent increase in sales (omitting currency fluctuations) to $2.29 billion beating analysts estimates. The Asia-Pacific region accounted for 31 percent of Richemont's sales during the quarter.

It's difficult to ignore numbers like that especially when Consumer Confidence Index rose 7.3 points to 60.6. Feeling better about the economy mixed with a little "frugal fatigue" may be the exact combination luxury retailers need in order to have a full recovery. With that said, there is a Chloe handbag AND a pair Christian Louboutin heels that I've been eyeing for months now. 18 months to be exact.

The REIT stuff: Dillard's to get into the real estate biz

On the heels of reporting promising numbers for 3Q 2010 (net income was $14.4 million at 22 cents a share up from last year's $8 million at 11 cents a share) Dillard's ($DDS) announced today they will be moving into the real estate business.

Now, before you start thinking that makes no sense whatsoever, real estate investment trusts (REITs) come with tax benefits that do not exisist in other corporate structures. In a Security and Exchange Comission filing the company explained that forming a REIT might enhance its ability to access debt or preferred stock, which will enhance liquidity, indicating that Dillard's may be a) going to start expanding into new stores or b) re-vamping the already existing stores.

The retailer has hit numerous stumbling blocks in the past and was pretty much written off by Wall Street until 2007 where they launched a massive clean up effort. Management (mostly comprised of members of the Dillard family) started cutting underperforming stores, took a disciplined approach to inventory management, and started stocking the stores with better merchandise. Instead of trying to compete with retailers such as Kohl's ($KSS) Dillard's started to position itself as somewhere between a Macys ($M) and a Nordstrom ($JWN).

"Going into the REIT business is a genius move," says Jeffrey Roseman executive vice president of Newmark Knight Frank a New York commercial real estate broker. "It's like the age old notion that McDonalds isn't in the burger business, it's in the real estate business. This is just another way the retailer is able to increase income on their balance sheets apart from the sale of apparel."

According to thier annual report, Dillard's owns 241 of the 309 stores, roughly 78% of their doors.

Speaking of $JCG...

In the wake of their Saturday deadline, J.Crew recieved no additional takeover bids during their "go shop" period a provision that is frequently included in leverage buyout deals (the deadline for other potential companies to throw in their hats was on the 15th). Well today, the retailer announced they would be extending the deadline to February 15th for other/rival bids and to settle a shareholder lawsuit. As it stands, TPG Capital and Leonard Green have been the only ones to come to the table so far with a $3 billion offer. There was some talk about $SHLD and $URBN possibly throwing their hats in (it was reported by DealBook both retailers had signed confidential agreements to study J.Crew's books during the solicitation period) but it was unclear whether they were seriously considering counteroffers.

Retail hangover?

(Drawing by Seth Herzog)

The retail industry was bracing itself for the inevitable and it looks like it happened. No, sillys, Terry Lundgren is not stepping down as chairman and chief executive of Macys (M)-- it seems as though the consumer is experiencing a little bit of a "retail hangover."

(Drawing by Seth Herzog)

The retail industry was bracing itself for the inevitable and it looks like it happened. No, sillys, Terry Lundgren is not stepping down as chairman and chief executive of Macys (M)-- it seems as though the consumer is experiencing a little bit of a "retail hangover."

While same store sales seemed to beat everyone's expectations for November, December's numbers came with a thud. In the teen retailer space American Eagle Outfitters (AEO) and Aeropostale (ARO) reported significant declines of 11 percent and 5 percent. With rumors both retailers may be getting snapped up by private equity in a buy out situation, these numbers only fuel the speculation fire. Meanwhile, Abercrombie and Fitch (ANF) killed it by reporting a 15 percent comp increase due mostly in part to a disciplined inventory management. Joining the promo band wagon by getting rid of last year's full- price sales strategy didn't hurt the company either. This move allowed Abercrombie to slowly take away market share from its direct competitors. Gap (GPS) also reported an 8 percent decline in comp sales. By the looks of the overly promoted merchandise in both Gap and Old Navy stores the day after Christmas (stay tuned I am going to a post about my mall vists post festivus/holiday) and the days following, no wonder no one was in there purchasing! It looked like a clothing bomb went off in the stores and not in a good way; too many cheap sweaters, jeans and active wear spelled disaster for this retailer. Ew.

On the other hand, luxury retailers saw an incredible rebound compared to this time two years ago. Saks Inc. (SKS) and Nordstrom (JWN) reported a gain in same store sales of 11.8 percent and 8.4 percent. Although Tiffany & Co. (TIF) just got downgraded by Jeffries from a "buy" to a "hold" on Thursday, store traffic as well as sales seemed to flourish during the holidays.

"I think the luxury customer came out and actually shopped for pleasure, not replenishment," said Deb Weinswing in an interview with Womens Wear Daily. "There is a 'V-shaped' recovery in luxury, and at the moderate retailers, it's more like a bathtub shaped curve. We're heading in the right direction."

I could not agree with Deb more.

Hitha's picks: Luxury

Ralph Lauren (RL): While a lot of luxury retailers (and retailers in general) are talking about their strategy in Asia, Ralph Lauren is actually executing it. The company has strong wholesale sales across all categories as well as strong online and store comps, net income rose 15.6% total revenues up by 11.5%

Tiffany & Co. (TIF): Yes, many analysts are getting behind Jeffries in their downgrade move on this stock but I'm not so sure I want to go there yet. The company is dillgent about providing inventory mixes across all price points, the stock up more than 51% year-to-date and same store sales jumped 7% for 3Q and management raised guidance. What's more Europe and Asia look like strong growth areas for the retailer.

Bluenile.com (NILE): Join the club if you were one of the many who asked for a watch or a piece of jewelry for the holidays and got it. The watch and jewelry category posted 15% increase for November/December. Coupled with 12% increase in e-commerce spending in the US for first 40 days of holiday (Comscore) Bluenile.com is in a good position going into 2011. According to the chief executive of the company, Traffic to the website increased 1000% first two weeks of November. But don't think Bluenile.com is placing all of its bets on world wide web--this online retailer is leveraging social media and smart phone Apps to reach customers.

Do you think the luxury consumer will experience the same "hangover" in 2011?

The Style File Daily Cheat Sheet

Is Fashion Ready to Break New M&A Ground?

There’s a new theme in fashion M&A that has “synergy” taking a back seat to “innovation.” “This is like the geek trying to get the hot cheerleader to become cool at the high school dance,” said Sherif Mityas, a partner in A.T. Kearney’s retail consulting practice, describing the rush of companies searching for businesses that have the pulse of new consumers. Fashion players and retailers are trying to get smart, and quick, on everything from social media and mobile commerce to celebrity — and they’re willing to think differently to do it. New players are also entering the mix, making for some pretty interesting bedfellows. Take Wal-Mart Stores Inc., which bought video download site Vudu. Denim brand J Brand sold a majority interest, said to be worth more than $50 million, to Star Avenue Capital, a partnership between talent agency Creative Artists Agency and Irving Place Capital. And the Estée Lauder Cos Inc. acquired Smashbox, picking up expertise in digital, social media and television distribution, as well as a photo studio to boot. Looking beyond the traditional boundaries of fashion can lead to a big payoff. “These are beyond synergistic type of opportunities,” said Mityas. “The opportunity will allow an organization to completely shift and create a new customer demographic, a new customer pool.” Mityas described innovation as the “holy grail” of growth and said the industry is beginning to see innovation through M&A. “This type of acquisition, in certain cases, allows you to leapfrog your competitor,” he said. This emerging M&A model is a distinct departure from the traditional one, where retailer A buys retailer B, reaching new customers while “realizing synergies” — firing people in the back office and dumping duplicate operations. The same can be done with brands and the model, at least on paper, leads to a larger company that is more profitable than the sum of its two parts. Most of fashion’s dealmaking is expected to proceed along these lines, but the great recession has changed things. Being big doesn’t seem as important as being in the right spot as consumers evolve and technology advances. But there are plenty of risks. Venturing into new areas can lead to cultural clashes and taking on a disparate business can distract management and pull them away from their core competencies. Hot companies with new ideas and lots of growth ahead of them can also be pricy. Take Under Armour Inc. and Lululemon Athletica Inc. in the fashion world. Both public companies, while not necessarily for sale, have successfully tapped into very specific customer niches, giving them leverage to drive up the price for any possible suitors. read more

Schumer Bill Seeks to Protect Fashion Design

The American fashion industry has been pushing hard over the last four years for copyright protection for its designs. An earlier bill in the House was deemed too broad; clothing makers argued that protection against knock-offs would only encourage frivolous lawsuits from people claiming they had the idea first. Today, after a year of negotiations, Senator Charles E. Schumer introduced a bill that seemed to satisfy the different sides of the fashion industry — and may provide some protection, too. The bill, the Innovative Design Protection and Piracy Prevention Act, has the support of the Council of Fashion Designers of America (CFDA), whose individual members represent the creative core of the industry, and the American Apparel & Footwear Association (AAFA), which represents more than 700 manufacturers and suppliers and by its estimate accounts for about 75 percent of the industry’s business. The AAFA had argued that the House bill was too broad and would expose its members to lawsuits. Senator Schumer brought the two groups together. “In the first go-around there was nothing that gave our members protection,” Kevin Burke, president and chief executive officer of the AAFA said, adding that there was “a vast difference” in the Schumer bill. “It provides the protection for unique design.” The proposed legislation provides very limited intellectual property protection to the most original design. A designer who claims that his work has been copied must show that his design provides “a unique, distinguishable, non-trivial and non-utilitarian variation over prior designs.” And it must be proven by the designer that the copy is “substantially identical” to the original so as to be mistaken for it. The bill would cover all fashion designs, including products like handbags, belts and sunglasses, for a three-year period from the time the item is seen in public—on a runway, say. Factors than can’t be used in determining the uniqueness of a design are color, patterns and a graphic element. In other words, the bar is extremely high to determine what qualifies as a unique and distinguishable fashion design. And the burden is on the innovative designer. A beautiful dress worn by a celebrity at an important red-carpet occasion most likely wouldn’t meet the test. But a jacket that has an original cut — one example might be Martin Margiela’s peaked shoulder jackets from two or three years ago — could easily meet the standards of something unique and non-trivial. The Margiela jacket was widely copied and certainly the knobby shape of the shoulder was original. Steven Kolb, the executive director of the CFDA, seemed satisfied with the Schumer bill, which has bipartisan support. “The fact that there will be a law in this country, as there are in other developed countries, will make people think twice” before they copy someone, he said. “The law in itself is a powerful deterrent.” Senator Schumer acknowledged that not every creative designer will feel that he or she is sufficiently protected but he said “the bill is a good first step.” He expected the bill to be passed this fall. Narciso Rodriguez, who was among the designers urging protection, said in an email: “It’s an important moment for American designers that this bill is one step closer to becoming law. This protection has been necessary for so long and I am happy to see how the fashion industry’s efforts have made a difference.” Extending copyright protection to fashion has been a hard sell, in part because consumers ultimately benefit from such copying. In a post this spring on the Freakonomics blog, Kal Raustiala of the UCLA Law School and Chris Sprigman of the University of Virginia Law School pointed to the paradox in piracy protection: “The interesting effect of copying is to generate more demand for new designs since the old designs—the ones that have been copied—are no longer special. The overall result is greater sales of apparel.” Perhaps the upside for American fashion is that it will encourage designers to be more innovative. read more

Tween Helps Lift Dress Barn Sales 78.3%

The November acquisition of Tween Brands and healthy same-store sales growth helped Dress Barn Inc. raise its fourth-quarter revenues 78.2 percent. Sales for the 13 weeks ended July 31 totaled $710.9 million, the company said Thursday, versus $398.9 million in the prior-year quarter. Comparable-store sales rose 7 percent overall. By nameplate, Dress Barn sales rose 11.3 percent to $282.3 million on a 5 percent comp increase and Maurices sales were up 26 percent to $183 million on an 8 percent comp increase. Comps at Justice, previously operated by Tween Brands, were up 10 percent as sales hit $245.6 million. For the year, company sales rose 58.9 percent to $2.37 billion from $1.49 billion on a consolidated comp increase of 9 percent. The company reaffirmed its guidance for earnings per share of between $1.80 and $1.85 a diluted share. Dress Barn is scheduled to report fourth-quarter and full-year results on Sept. 15.

The Style File Daily Cheat Sheet

Liz Claiborne Losses Grow

Liz Claiborne Inc. said Thursday that its second-quarter net loss widened, despite margin improvement at its Juicy Couture, Kate Spade and partnered brands divisions. The New York-based retailer amassed a net loss of $87.2 million, or 92 cents a diluted share for the period ended July 3, compared with a loss of $82.1 million, or 82 cents a share, in the year-ago quarter. Excluding items, Liz said its net loss totaled 19 cents a share, which was better than analysts’ estimate of a 46-cent loss. Revenue for the quarter slid 15.5 percent to $569.8 million, from $674.6 a year earlier, due in part to lagging sales at Liz Claiborne brands, which are licensed to J.C. Penney Co. Inc. and television shopping network QVC. read more

Chinese luxury wannabes try to shake off "Made in China" image

"I threw away the rest of my suits," beams Buffett in the 2007 video, adding that he and Microsoft founder and Bill Gates are fans of Chinese suit maker Trands and would be great salesmen for the company based in the northeast Chinese city of Dalian. Trands is one of a handful of emerging Chinese brands that someday hope to take on the likes of Gucci, Armani and Prada in the lucrative luxury goods market. Sales of luxury goods in China grew 12 percent in 2009 to $9.6 billion, accounting for 27.5 percent of the global market, according to Bain & Co. In the next five years, China's luxury spending will increase to $14.6 billion, making it the world's No. 1 market. Buffett's endorsements may make for fun Internet fodder, but analysts point out that the emerging crop of Chinese luxury wannabes face a long uphill battle in taking on the global heavyweights which have more than a century of history and huge marketing muscle. Compounding the problem is a longstanding association that equates the "Made in China" label with poor quality and mass-market goods, versus the more exclusive cachet of the "Made in Europe" moniker. "In the short term I don't think any Chinese luxury brands can compete with the international ones in terms of marketing, brand culture, design and quality," said Marie Jiang, JLM Pacific Epoch analyst. China is expected to become the world's biggest luxury goods market in five to seven years, fueled by increasingly wealthy and brand-conscious consumers who want the best of everything, said a survey by The Boston Consulting Group in January. That market has been largely dominated to date by the big Western names, most of which have shops in Shanghai and Beijing and are starting to look at smaller cities as well. But home-grown brands such as Trands are trying to raise their profile both at home and abroad to get a piece of the lucrative luxury pie. Ports, another luxury fashion maker founded in 1961, made its own splash by wooing celebrities and sponsoring clothing for the 2006 movie "The Devil Wears Prada."

FINICKY CONSUMERS

Aspiring Chinese luxury brands may face their toughest battle on the homefront, where shoppers often prefer big international names such as France's LVMH or Hermes that carry more prestige and more than a century of history. One of the few brands to gain anything approaching an international following is Shanghai Tang, a designer of brightly colored chic clothing featuring Chinese themes founded in Hong Kong and now with stores worldwide. "They are brand conscious, it is a little bit of a show-off attitude and what we have seen is that when they have money, they tend to spend on well-known brands," said Renee Tai, an analyst with CIMB-GK Research, referring to Chinese consumers. Chinese brands could face an even rougher road ahead as global brands, well aware of China's rapidly growing wealth, launch major expansion campaigns in the country that include opening stores in second and third-tier cities. Louis Vuitton will open one of its largest stores in the world in Shanghai this year. In the past year, LV has opened stores in second-tier cities of Xian, Xiamen and Tianjin. London's upscale department store Harrods is also rumored to be in talks with Shanghai's municipal government to open its first store outside the United Kingdom. International brands are also adapting to China, with Hermes rolling out a new brand, "Shang Xia" offering luxury accessories at cheaper prices just for China. "They face competition and I think in terms of them being able to take a dominant share of the market, that's sometime off," said Stephen Mercer a partner at KPMG Shanghai. He said Chinese luxury brands could succeed in niche areas such as spirits and jewelry, with Moutai, a Chinese spirit that was served to Richard Nixon during his famous China trip during his presidency, as one such example. read more

(wwd)Barneys Said Near Naming Mark Lee CEO

Barneys New York might have a chief executive officer at last. Mark Lee, who stepped down as Gucci’s president and ceo in December 2008, is in advanced talks to become ceo of Barneys, according to market sources. Lee’s name has been bandied about as a favorite to lead Barneys practically since his exit from Gucci, which came only a few months after Howard Socol stepped down as the store’s chief in July 2008, leaving it without a ceo ever since. It is understood a contract has yet to be signed, but executive search circles are abuzz that Lee — one of the most admired and sought-after executives in the industry — is the clear front-runner. The dapper and slim fashion veteran, who earlier this year joined the boards of Tory Burch and Italian online retailer Yoox SpA, recently has been spotted walking Barneys’ 10-level, 235,000-square-foot Madison Avenue flagship. Lee was traveling Wednesday and could not be reached for comment. A Barneys spokesman did not respond to a request for comment by press time. His appointment would certainly electrify the American retail scene — and heighten the competition in New York at a time when Saks Fifth Avenue continues its turnaround and Bergdorf Goodman is undergoing management changes, with president Jim Gold, come October, splitting his time between Dallas and Manhattan when he becomes president of Neiman’s specialty retail division, which includes Neiman Marcus stores as well as Bergdorf’s. read more

The Style File Daily Cheat Sheet

(wwd)San Francisco Merchants Indicted in Major Counterfeit Ring

Calling it the largest enforcement action against counterfeit goods on the West Coast, U.S. Immigration and Customs Enforcement said Tuesday that a long-term investigation involving $100 million of counterfeit luxury goods has led to the indictments of 11 merchants and clerks from San Francisco’s Fisherman’s Wharf district. A 25-count indictment charges the defendants with trafficking in counterfeit goods, smuggling and conspiracy. ICE revealed details of the case late Tuesday, after it was unsealed Monday in federal court. ICE said agents seized apparel and accessories bearing fake trademarks of more than 70 brands, including Coach, Kate Spade, Nike, Oakley, Armani, Burberry, Louis Vuitton and Prada. Goods seized included clothing, jewelry and watches, scarves, handbags and wallets, sunglasses and shoes. The investigation by ICE and Homeland Security Investigations agents into the Fisherman’s Wharf retailers started in December 2007 when U.S. Customs and Border Protection officers intercepted a container at the Port of Oakland containing more than 50,000 counterfeit accessories valued at more than $22 million. The seizure gave the agents the information necessary to target a total of eight shops, as well as nine residences and three storage units in the San Francisco and San Leandro areas over the next several months. The 11 defendants face penalties of up to 20 years in jail and a $250,000 fine for smuggling goods, 10 years in prison and a $2 million fine for each count of trafficking in counterfeit goods, and five years in jail and a $250,000 fine for conspiring to traffic in counterfeit goods, according to ICE. The case is being prosecuted by U.S. Attorney Deborah Douglas and is part of the Justice Department’s Intellectual Property Task Force. “To consumers who think designer knockoffs are a harmless way to beat the system and get a great deal, ‘buyer beware,’” said John Morton, director of ICE. “Trademark infringement and intellectual property crime not only cost this country much needed jobs and business revenues, but the illegal importation of substandard products can also pose a serious threat to consumers’ health and safety.” Federal officials have increased their focus on stopping the flow of counterfeit goods into the U.S. In April alone, ICE seized an estimated $260 million of fake apparel, accessories and other merchandise, a record month for seizures. In the first half of 2010, the agency has already initiated 560 intellectual property cases. In fiscal 2009, ICE initiated 806 intellectual property theft cases, up from 643 in 2008. The domestic value of goods seized for intellectual property violations in 2009 was $260.7 million, according to statistics from Customs & Border Protection. Sales of counterfeit goods cost legitimate businesses an estimated $250 billion a year in lost sales and revenues worldwide, and are responsible for the loss of 750,000 jobs, according to estimates from the International AntiCounterfeiting Coalition. read more

(AP)Coach 4th-quarter net income rises

Luxury handbag maker Coach says better sales in North America and Asia helped its fourth-quarter net income rise 34 percent. The increase is a sign that Coach's lowered handbag prices and focus on growth in China is paying off. The company says net income rose to $195.5 million, or 64 cents per share. That compares with $145.8 million, or 45 cents per share, last year. Analysts expected 56 cents per share. Revenue rose 22 percent to $950.5 million. Analysts expected $888.9 million. Coach Inc., based in New York, says an extra week in the quarter boosted revenue by $70 million. CEO Lew Frankfort says market share grew in all regions. Revenue in stores open at least a year rose 6.3 percent in North America.

(wwd)Back-To-School Sales Seen Soft in July

There’s unlikely to be a breakout in back-to-school business when stores report July comparable-store sales on Thursday. Preliminary reports indicate that consumers, content in June to leave their b-t-s shopping for later in the summer, kept procrastinating last month. Evidence is growing that they might need more promotional coaxing to open up their wallets, which could hurt third-quarter margins. “July, with scorching weather and decent traffic trends, should have ensured a solid start to the back-to-school season,” said Brean Murray, Carret & Co. analyst Eric Beder. “Instead, high inventory levels from key players, continued weak economic trends and the consumer shopping later in the season have combined to create what will probably be one of the most aggressive discounting seasons in recent memory, as there are already material price cuts on key categories such as denim and Ts.” Beder said results, particularly in the teen market, were not expected to improve through the b-t-s season, leaving retailers such as American Eagle Outfitters Inc., Abercrombie & Fitch Co. and The Wet Seal Inc. with a glut of inventory or an “unappealing” pricing model. Mike Berry, director of industry research for MasterCard Advisors SpendingPulse, was slightly more upbeat. Although apparel sales slipped 1.1 percent on a year-over-year basis in July, according to MasterCard data, sales at family retailers, a category that includes teen retailers, edged up 3.4 percent. SpendingPulse estimates total U.S. retail sales made by cash, check or credit card. Wary because of the rough-and-tumble action on Wall Street, luxury consumers cut spending last month, driving down jewelry sales 1.2 percent, including a 13 percent dive in high-end jewelry. Excluding jewelry, overall luxury spending was down 0.2 percent, according to Berry. Berry said, “Until consumers see encouraging news over a substantial period of time, they will continue to be skittish.” read more

(wwd)Madonna's Fashion Line Draws Crowds in New York

If you are looking to dress like Madonna from her early days, here you go, oh and you must be a tween. Madonna's new junior's line is exclusively at Macy's, and somehow managed to draw a crowd of mini-Madonna teeny boppers. We can't help but wonder if they even know the songs that made Madonna a legend, and why would anyone feel the need to bring back that style?

Macy’s rolled out the pink carpet for Madonna fans on Tuesday. The performer’s enthusiasts were out in force at the Herald Square flagship for the launch of the Material Girl collection by Madonna and her daughter Lourdes, sold exclusively at the store. But while the collection generated lots of buzz at Herald Square, where all the festivities were centered, in other Macy’s outside New York, it was less of an event and drew fewer shoppers. Nonetheless, the retailer’s executives remain optimistic about the collection, which is being produced by MG Icon, a joint venture of Madonna, her manager, Guy Oseary, and Iconix Brand Group Inc. — which has already paid Madonna and Oseary $20 million for its 50 percent stake, plus earn-outs. So while Madonna and Lourdes won’t make an appearance for the line until Sept. 22, when they meet sweepstakes winners at the flagship, they no doubt were closely monitoring initial reaction. Teens with blonde streaks in their black hair and dark eye makeup, dressed in black tulle skirts and leggings, waited for the Herald Square flagship to open. A line wound its way from Broadway to West 33rd Street. The first 200 customers on line at six Macy’s locations received a bandeau top from the collection and a $10 Macy’s gift card. Taylor Momsen, the face of the Material Girl collection in advertising and marketing, performed an acoustic set later in the afternoon on the junior floor at the Herald Square location. Like her muse, Momsen has sparked controversy lately for her provocative style choices and for smoking. “In my day, we had Madonna,” said a mother attending Momsen’s appearance with her daughter. “We talk about smoking at home and how bad it is for her. No one in our family smokes. I don’t think Taylor influences how my daughter dresses. Everyone makes their own decisions on how to dress.” “This is beyond anything I’ve seen in my career,” said Terry Lundgren, chairman, president and chief executive officer of Macy’s Inc. “We’ve had 700 million Internet impressions since the collaboration was announced. Word of mouth took off and a grassroots” campaign started. “This has such broad appeal.” read more

(wwd)Defining the New Luxury

Luxury for all? Not like it used to be. So-called aspirational customers — who helped lift the luxury category to unprecedented heights during the boom years — seem to be sitting on the sidelines in the postrecession period: still aspiring, but spending less. “The concept of luxury has restricted again,” said Concetta Lanciaux, principal of Switzerland-based Strategy Luxury Advisors, describing a shift in consumer priorities favoring heritage luxury brands or — at the other extreme — masstige retailers. It makes business more challenging for players in the middle and products that “look like luxury but it’s not luxury.” For example, designers’ second brands are “not doing as well as before [People] prefer to buy less, but a little bit higher,” she explained. “There are consumers that overreached, and during the recession they had to go back to a more appropriate spending habit,” agreed Michael Burke, chief executive officer at Fendi in Rome, noting that was particularly the case in the American market, hard hit by the financial crisis. “The market has become more polarized: either it’s entry price or true luxury….The middle has hollowed out. “You either have to be resolutely upscale, or you’re battling it out on prices,” he continued. “[Luxury goods] is not a democratic product category.” Pam Danziger, president of the Stevens, Pa.-based research firm Unity Marketing, said scores of American consumers who reached beyond their means into the luxury sphere during the boom years pre-2008 have since simply “dropped out” because of the recession. Danziger estimates consumers with household incomes in excess of $250,000 — the top 2 percent in the U.S. — spend three to four times more on luxury goods than the next affluent tier, those in the $100,000-to-$250,000 range. What’s more, given a choice between buying the “best of the best” or “better and occasional best,” the richest consumers preferred the latter option in her most recent research. Based on a survey of some 1,200 affluent consumers in the U.S., conducted last month, Danziger is predicting “cautious behavior” even among elite consumers whose “pent-up demand” for luxury goods led to a spree early in the year that is unlikely to continue. Lanciaux also foresees a tougher second half, noting European luxury brands were buoyed in the first two quarters by a “huge restocking,” plus a rise in the value of the U.S. dollar against the euro that has since eased. read more